In 2025, India’s stock market is witnessing an unprecedented surge in Initial Public Offerings (IPOs), with the Bombay Stock Exchange (BSE) leading the charge. This surge is predicted to continue, setting new records for the Indian economy. Here’s everything you need to know about this remarkable IPO boom and what it means for the future of Indian business.

The Phenomenal IPO Growth in India

2025 is shaping up to be another record-breaking year for India’s stock market as over 90 companies are preparing to raise approximately ₹1 trillion (around $11.65 billion) through IPOs. This trend follows a record year in 2024, during which 91 companies raised ₹1.6 trillion via IPOs, highlighting the increasing investor confidence in India’s economic landscape.

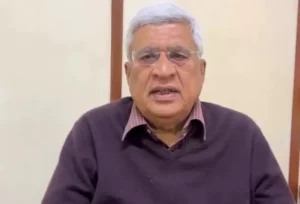

According to BSE CEO, the exchange is expecting a steady increase in IPO activity over the coming years, as more Indian companies seek public listing to fuel their growth and expansion plans.

Key Factors Behind the Surge

- Strong Investor Sentiment: The Indian stock market has experienced impressive gains in recent years, attracting global investors looking for high returns. The IPO surge is a clear sign of confidence in India’s economic growth and stability.

- Diversification of IPO Offerings: More companies from various sectors, such as technology, healthcare, and consumer goods, are tapping into the IPO market, bringing fresh and diverse investment opportunities to the table.

- Government Initiatives: Proactive steps taken by the Indian government to boost market reforms and ease IPO processes have further incentivized businesses to go public.

BSE’s Strategy to Support IPO Growth

The BSE is making significant strides to ensure the success of its IPO initiatives. One of the key steps in this direction is the introduction of co-location services, which will allow high-frequency and algorithmic traders to access market data faster and more efficiently, driving more participation from traders and investors.

Additionally, BSE’s efforts to expand its index business and focus on niche financial products are expected to attract more companies looking to list on India’s premier stock exchange.

What Does This Mean for Investors?

The record-breaking IPO activity is great news for investors. As more companies go public, it creates a wide range of investment opportunities, offering potential high returns. However, as the market heats up, investors need to be strategic in their choices, conducting thorough research and consulting with financial advisors before diving into any IPO.

India’s Global Position as a Leading IPO Market

India’s IPO market is quickly becoming one of the most attractive investment destinations globally. The growing number of successful IPOs is not only contributing to the country’s economic growth but is also increasing its global market presence.

This surge in IPOs reflects India’s booming startup ecosystem, with new-age tech companies, including Fintech and Edtech startups, leading the way. As a result, India has become a top contender for the most lucrative IPO market in Asia.

Challenges and Considerations for the IPO Boom

Despite the exciting growth in IPOs, there are several challenges that could affect the ongoing boom:

- Volatility in Global Markets: The global economic environment can have a significant impact on the IPO market. If international market conditions worsen, it could lead to a slowdown in IPO listings.

- Regulatory Changes: As the IPO landscape grows, stricter regulations may be implemented, which could increase the cost and complexity of going public.

What to Expect in 2025?

The IPO wave shows no signs of slowing down in 2025. Analysts predict that the next year could see even more IPOs than in 2024, with a mix of tech startups, traditional companies, and even state-owned enterprises seeking public listings.

With the BSE gearing up for a record-breaking year, it is clear that India is poised to continue its rise as a global leader in the IPO market.

Where to Keep Track of IPO Updates

To stay updated on the latest IPO news and developments, visit trusted sources such as:

- BSE IPO Section for real-time information on upcoming listings and market trends.

- Reuters IPO News for expert analysis and updates on market conditions.

You can also follow stock market experts and subscribe to financial news portals for insights on the latest IPOs, expert reviews, and market forecasts.